LPP stepping up growth. Third quarter of 2024 with strong double-digit sales dynamics and record growth in e-commerce

- The positive reception of the autumn collections of LPP brands and the widely implemented plan to expand the sales network allowed the company to generate PLN 5.2 bn in revenue in the third quarter of this year, recording an increase of 19.8 per cent YoY.

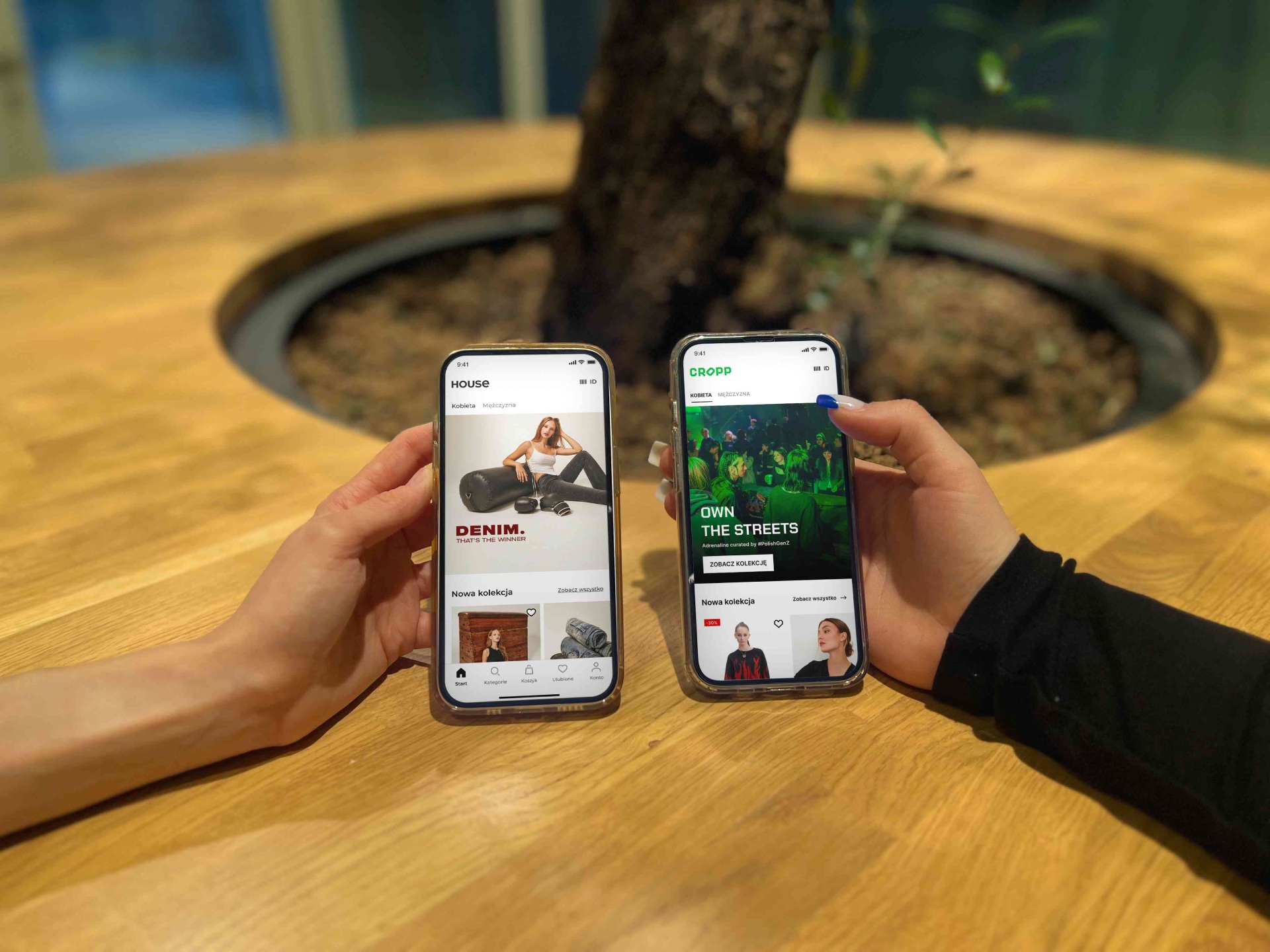

- Double-digit sales growth in Poland and abroad is also a result of record e-commerce growth of 35.7 per cent YoY, driven mainly by mobile applications developed across all brands.

- Focusing on growth plans did not prevent the company from generating a solid gross margin of 54.8 per cent and achieving a stable net profit of PLN 577 mn.

- LPP is stepping up the pace of growth, with plans for an accumulation of openings and nearly 300 new stores in the last quarter of this year.

- The company announces ambitious plans for 2025 – It intends to double the number of Sinsay brand stores and open around 100 stores of other brands, as well as debut in two new foreign markets.

- Supporting these plans is the further strengthening of the logistics operating capacity and increasing warehouse space to over 700,000 square metres by the end of 2025.

The beginning of the second half of 2024 at LPP was marked by positive consumer sentiment, which is reflected in double-digit sales growth in both the traditional channel (+19.4 per cent YoY) and online (+35.7 per cent YoY). The visible recovery is due to the hit collections and the consequence of the dynamic expansion of the sales network in recent quarters, especially of the Sinsay brand, which is yielding the expected results. A growing support in revenue generation is online sales, which in the third quarter of this year accounted for more than 26 per cent of total sales. The company managed to generate a gross margin of 54.8 per cent and a stable net profit of PLN 577 mn. In turn, since the beginning of the year, the Group has achieved over 21 per cent YoY growth in adjusted operating profit and nearly PLN 3 bn in EBITDA.

– It was a very challenging but also successful quarter which brought LPP brands the expected recovery among customers. The results achieved during this period are also proof that our assumptions on building a competitive advantage based on a strong and customer-accessible stationary network are most justified. An important element complementing this strategy is e-commerce, which in recent months has brought us a positive surprise in the form of very high growth of over 35 per cent. Notably, already all our brands are available on mobile apps, which essentially dominate the online channel. We can see that the customer appreciates our unique business model and that our brands meet their expectations for both collections and shopping experiences. All of this prompts us to accelerate the pace of our already ambitious growth plans — comments Marcin Bójko, vice-president of LPP’s management board.

In 2024, LPP Group intends to open a total of around 650 new stores in Poland and abroad. In turn, by the end of 2025, the Gdańsk-based manufacturer wants to double the number of Sinsay stores and increase the Group’s sales network to 4,400 stores. The implementation of the plan to expand the stationary network while supporting sales through a strong online channel is expected to allow the company to double its sales compared to YoY 2023 in the next two years. The road to achieving this goal, however, requires significant capital expenditure, which in the third quarter of this year increased by 79 per cent YoY to PLN 519 mn, including the majority for new store openings, but also for logistics and IT.

The effects of intensive expansion of the network and investments in operational and human resources capabilities to support the Group’s growth can be seen in the dynamics of SG&A costs, whose share in sales amounted to 40 per cent. Compared to the same period last year, 368 stores were added to the LPP network (+135 stores in the third quarter of this year alone), with the largest number of openings in South-Eastern Europe (SEE). Overseas sales account for an increasing share of LPP brands’ revenue (56 per cent), and its growth rate in Q3 2024 reached nearly 25 per cent YoY. Poland remains the most important market, growing at 18.3 per cent per year. Outside the country, Romania, the Czech Republic and Hungary, among others, generated the most revenue.

The evident growth potential in the southern part of Europe is prompting the company to invest further in the region, which is why LPP intends to debut in two new markets as early as 2025. – Recent years have not encouraged businesses to take bold steps, but we believe that now is the perfect time to impose an even greater pace of growth. We want to fight harder for the customer’s attention in Southern Europe and we believe that our debuts in Albania and Kosovo, planned for 2025, will complement our presence in this region and will strengthen the potential of our brands – announces Marcin Bójko, vice-president of the management board of LPP.

Parallel to the expansion of the stationary network, the company intends to strengthen e-commerce, mainly through applications. Since October this year, Polish customers can already use the mobile apps of Cropp and House brands. This means that in Poland all LPP brands are already available in this channel. The company also intends to expand the reach of the app to other countries: Reserved will appear in the UK, Bulgaria and Lithuania, Mohito in the Slovakian and Hungarian markets, while Cropp and House in the Czech Republic and Romania. And Sinsay, which recently debuted in Germany and Greece, will soon be available in Italy and Lithuania. In the markets where it is already available, it generates almost 70 per cent of online sales.

Following its investment in the development of multi-channel sales, the company is strengthening its logistics operating capacity. The company’s Foreign Distribution Centre near Bucharest has gained an additional 42,000 m2. An expansion of the Distribution Centre in Brest Kujawski by a further 85,000 m2 is also underway. By the end of 2025, the LPP Group’s warehouse space is expected to increase to more than 700,000 square metres, with expenditures next year reaching approximately PLN 1 bn.

The capital expenditure planned by the end of 2024, the largest to date, at PLN 1.9 bn, including PLN 1.4 bn for stationary stores, is part of the strong growth announced for this year and ambitious plans to realise the potential of multi-channel sales. The company intends to continue this process in the coming years and already in 2025 increase the Group’s revenue to PLN 26 bn with a gross margin of 52-53%, double-digit growth in online sales and positive performance in LFLs.

– We have an even more intensive plan ahead of us to develop the stationary network, whose retail space we want to expand by 35-40% next year. This will entail increased investment expenditure of approximately PLN 3.5 bn. Of this, PLN 2.3 bn will be spent on opening new stores. The implementation of this year’s plans clearly demonstrates that the strategy we have adopted is delivering the expected results, and that our organic progress is translating into concrete sales results. We expect similar results next year – concludes the vice-president of the LPP’s management board.

______________________________________________________________________________

LPP is a Polish family business and one of the fastest growing clothing companies in the region of Central Europe. For 30 years, it has been successfully designing and selling the collections and accessories in Poland and abroad. LPP manages five fashion brands: Reserved, Cropp, House, Mohito, and Sinsay, whose offer is available today in stationary and online stores in 40 markets worldwide. The company has a chain of over 2500 stores with the total area of over 2 million m2 and distributes the products to 3 continents every year. LPP also plays an important role as it provides employment to 43 thousand people in its offices and sales structures in Poland, Europe, Asia, and Africa. The company is listed on the Warsaw Stock Exchange in the WIG20 index and belongs to the prestigious MSCI Poland index.