Fiscal year 2017

Although we are increasingly active on international markets and our brands are increasingly recognisable there, we do not forget our roots. Throughout this time it has been Poland where all the key decisions are made, and it is here that our clothes and accessories are designed. So it is obvious to us that LPP pays taxes in Poland.

In 2017, thanks to the taxes LPP once again contributed to the state budget. And this time the total amount of the amounts paid exceeded last year’s figures. As a Polish family business, we are extremely proud of this.

We are glad that along with the development of our Company, we are also contributing indirectly to the development of our country thanks to the payment of various levies and taxes to its budget. LPP wants to continue this progress and further support the Polish economy.

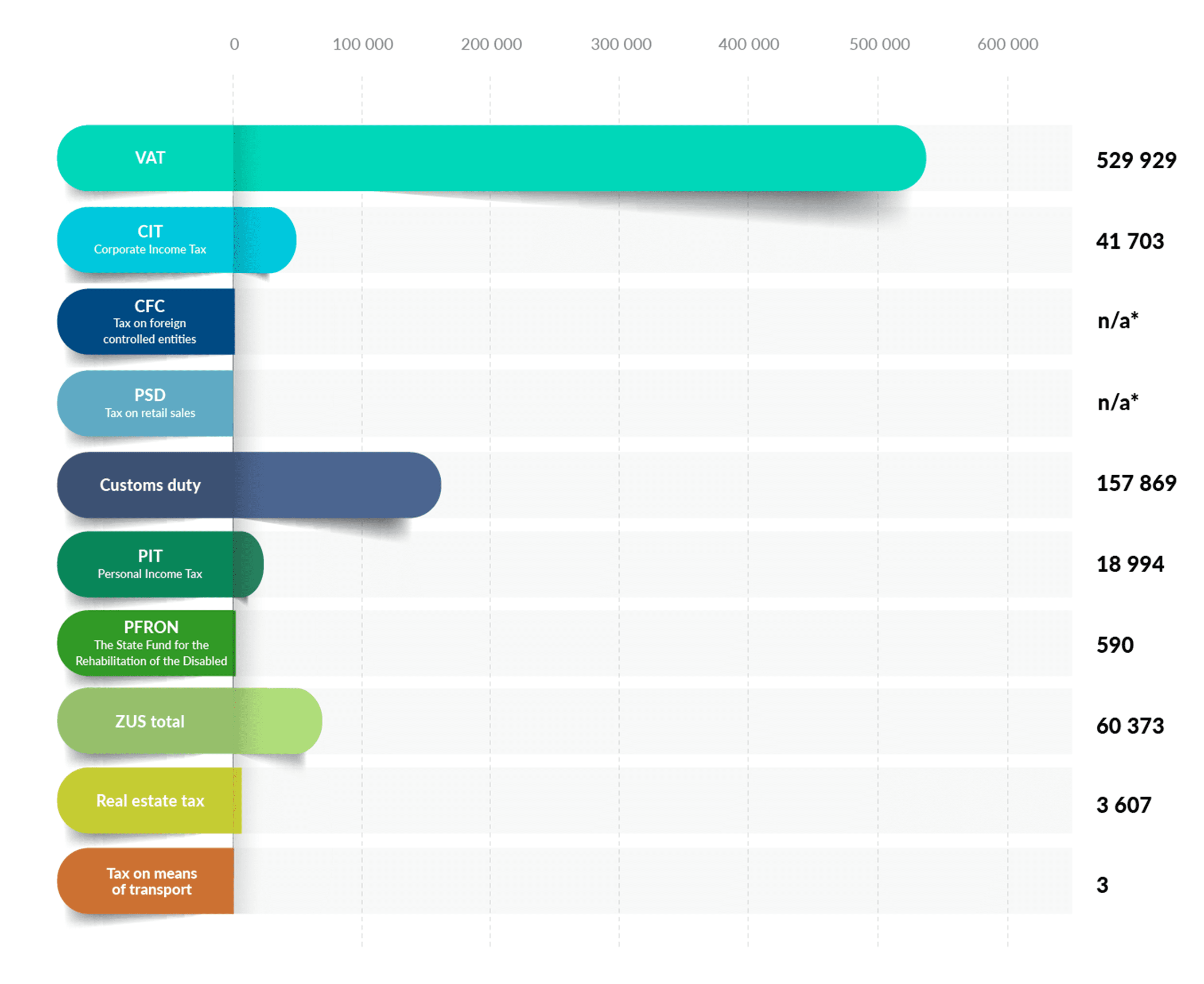

The table below shows our 2017 fiscal year. It contains detailed data relating to the amounts of individual obligations.

Taxes paid to the state budget in 2017

Fiscal year |

2017 |

|---|---|

VAT |

529,929 |

Corporate Income Tax – CIT |

41,703 |

CFC tax on foreign controlled entities |

N/A |

Tax on retail sales PSD |

N/A |

Customs duty |

157,869 |

Personal Income Tax – PIT |

18,994 |

The State Fund for the Rehabilitation of the Disabled (PFRON) |

590 |

ZUS total |

60,373 |

Real estate tax |

3,607 |

Tax on means of transport |

3 |

Total [PLN thousand] |

813,068 |

Data analysis

In 2017, in connection with obligations arising from various levies and taxes, LPP paid a total of PLN 813 m to the state budget. This amount consisted mostly of VAT, for which we paid nearly PLN 530 m. The second largest item was customs duty, which amounted to over PLN 157 m.

ZUS (contributions to the social insurance institution) and CIT paid by LPP in 2017 also constituted significant items in this respect. LPP allocated over PLN 60 m and over PLN 41 m in respect of the above. However, we paid nearly PLN 19 m in PIT, and over PLN 3.6 m in property tax.

Taxes paid to the state budget in 2017 (in PLN thousand)