Fiscal year 2020

The economic situation worldwide has deteriorated significantly due to the prevailing pandemic. Nevertheless, our family business from Gdańsk did its best to end the past year with a high tax contribution to the state budget. Although our brands are now recognised in many countries around the world, LPP is a Polish clothing company and hence we pay our taxes in Poland.

Despite the pandemic, we ended 2020/21 with results that allowed us to make a high tax contribution to the state budget. LPP made this happen by, among other things, responding quickly to global economic changes and meticulously implementing the company’s growth strategy.

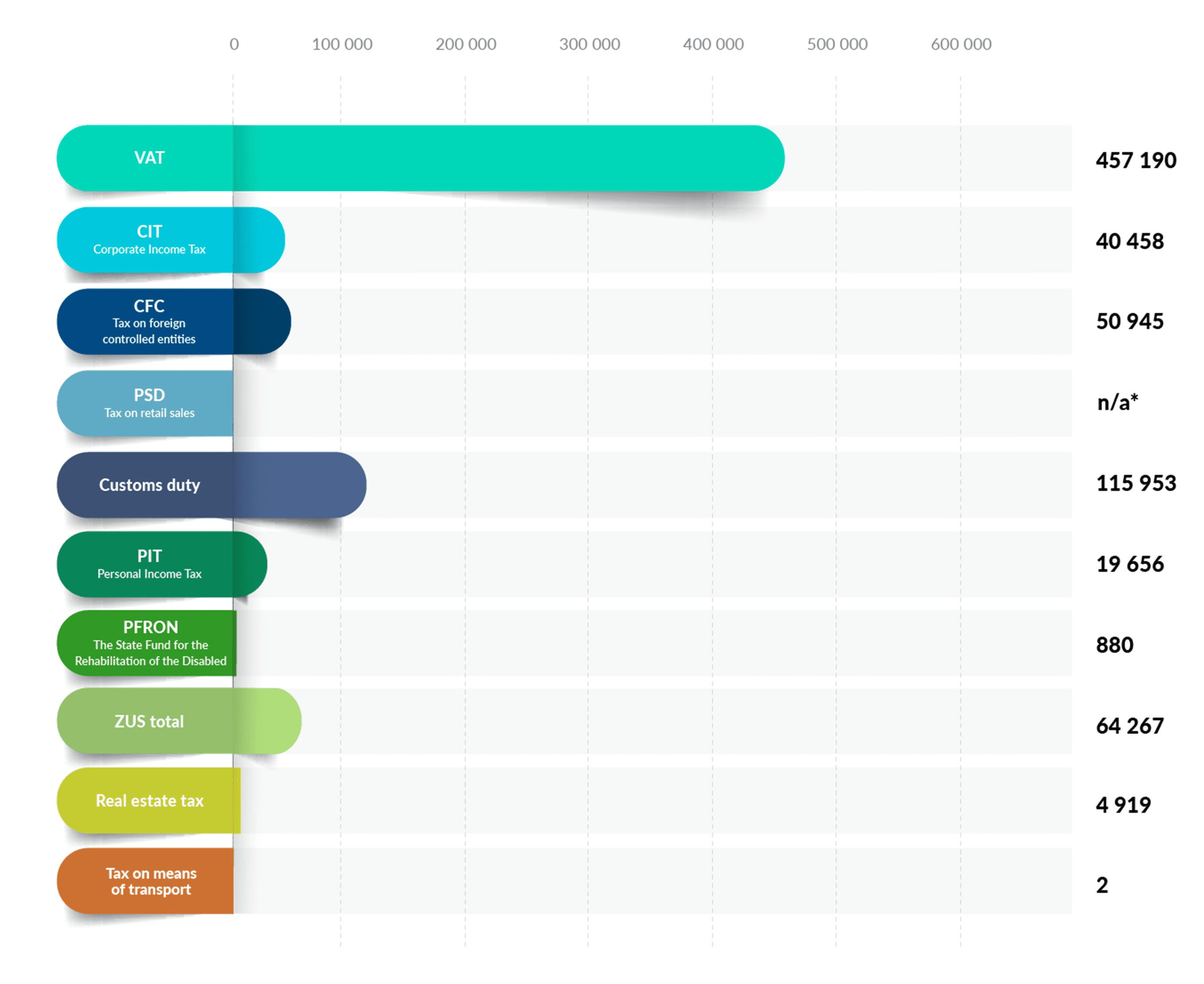

The table below presents LPP’s taxes for 2020/21. Not only is the total amount of the company’s taxes included – the total is broken down to clearly indicate the amount of proceeds from specific liabilities.

The table takes into account the amounts relating to the 2020/21 financial year, i.e. for the period from 02.2020 to 01.2021.

Taxes paid to the state budget in 2020

Fiscal year |

2020 |

|---|---|

VAT |

457,190 |

Corporate Income Tax – CIT |

40,458 |

CFC tax on foreign controlled entities |

50,945 |

Tax on retail sales PSD |

N/A |

Customs duty |

115,953 |

Personal Income Tax – PIT |

19,656 |

The State Fund for the Rehabilitation of the Disabled (PFRON) |

880 |

ZUS total |

64,267 |

Real estate tax |

4,919 |

Tax on means of transport |

2 |

Total [PLN thousand] |

754,270 |

The figures for 2020 are projections. The final figures will be provided in July 2021 after the tax return has been filed.

Data analysis

The contribution of LPP made to the state budget in 2020/21 exceeded a total of PLN 754 million. This amount consisted of various liabilities and levies, as well as taxes. LPP paid as much as PLN 457 million in VAT – the highest amount among all the company’s tax liabilities for the period analysed.

On account of other liabilities, LPP’s taxes also remained at a very high level. Last year, the company paid over PLN 64 million to the state treasury in social security contributions, and CIT exceeded PLN 40 million. Customs duty related to the international operations of the Gdańsk-based company, on the other hand, amounted to nearly PLN 116 million, and the company’s real estate tax to almost PLN 5 million.

Taxes paid to the state budget in 2020 (in PLN thousand)