Fiscal year 2016

In 2016, the total amount of taxes paid in Poland by LPP exceeded the result obtained in 2015. This was possible, among other things, thanks to the consistent development of the company not only domestically, but also on international markets.

The business model assuming the sale of clothes, accessories or other products that have been created on the basis of Polish know-how, also outside the country, allows us to grow in strength. Our growth, achieved, among other things, thanks to export, while paying taxes in Poland at the same time, translates into real support for the national economy.

We are planning to continue such a strategy and, consequently, we want to support the national budget on an even greater scale in the years to come, and to provide it with even greater amounts.

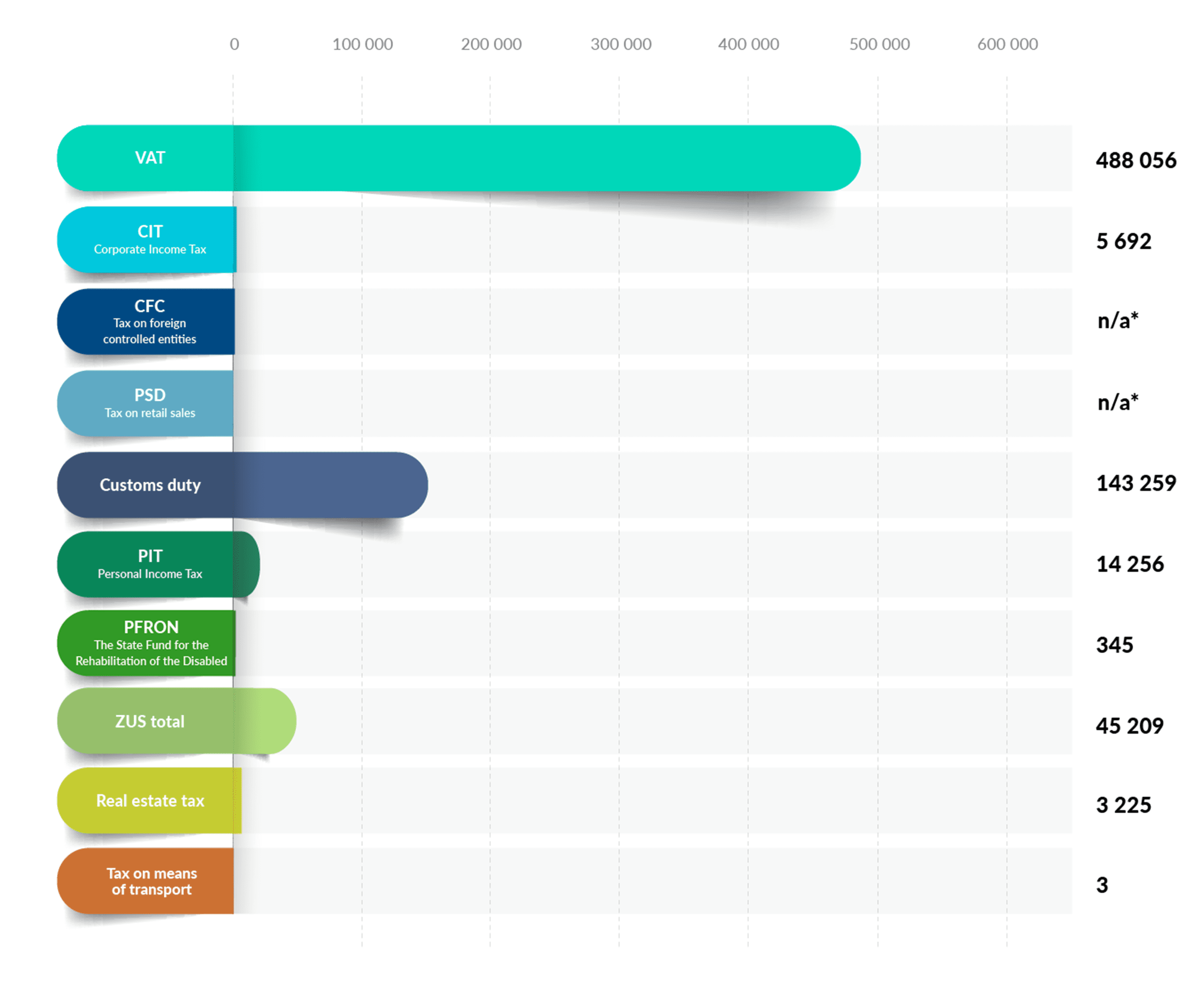

The table below shows taxes paid by LPP in 2016. The breakdown into the amounts resulting from individual obligations indicates specific sums which make up the total result.

Taxes paid to the state budget in 2016

Fiscal year |

2016 |

|---|---|

VAT |

488,056 |

Corporate Income Tax – CIT |

5,692 |

CFC tax on foreign controlled entities |

N/A |

Tax on retail sales PSD |

N/A |

Customs duty |

143,259 |

Personal Income Tax – PIT |

14,256 |

The State Fund for the Rehabilitation of the Disabled (PFRON) |

345 |

ZUS total |

45,209 |

Real estate tax |

3,225 |

Tax on means of transport |

3 |

Total [PLN thousand] |

700,045 |

Data analysis

In 2016, the state budget was credited with a total of more than PLN 700 m as various levies and taxes. The largest item on the list that contributed to this result was VAT amounting to over PLN 488 m. In connection with our international activities, however, we paid to the Polish state budget over PLN 143 m in customs duties.

The total amount of taxes paid by LPP in 2016 also comprised, among other things, ZUS contributions from employees and the employer, as well as health insurance contributions, which amounted to over PLN 45 m in total.

Taxes paid to the state budget in 2016 (in PLN thousand)